AT&T’s wireless predecessor, McCaw Communications, dominated the early wireless market in the US thanks to its savvy licensing of mobile spectrum. So it’s fitting that the modern-day AT&T Wireless is built on the foundation of diverse spectrum holdings, which Tutela’s unique crowdsourced data can show gives AT&T enviable coverage and spectrum capacity across the nation.

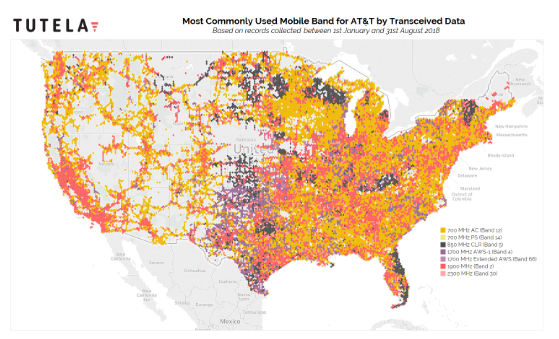

The map above shows the most commonly-used LTE band for AT&T across the US, based on Tutela’s crowdsourced dataset of millions of US cellular subscribers.

Compared to the maps from other operators, the key thing that jumps out is how truly diverse AT&T’s spectrum holdings are. Rather than relying on one band for rural coverage and one band for urban capacity, AT&T showcases more regional diversity.

Across the East Coast, for example, AT&T’s low-band 700 MHz holdings are king. The 1900 MHz band is the most popular in a handful of particularly dense urban areas, but 700 MHz dominates the majority of the landmass around the Great Lakes and down into the Southern states.

In California, however, it’s a completely different story. Although much of California has relatively sparse population and rugged terrain -- an ideal situation for low-band spectrum, which travels further and penetrates obstacles better than mid-band spectrum -- the 1900 MHz channel is the most popular for almost all of California.

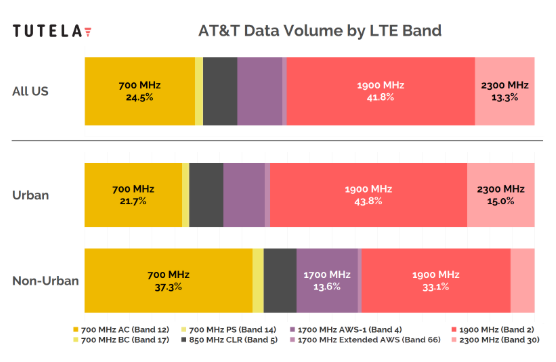

Tutela has also broken down data volume transferred by spectrum band, which shows which bands are doing the heaviest lifting in terms of data volume. Unsurprisingly, mid-band spectrum transfers the bulk of the data, thanks to its utility in urban areas.

Nationally, 1900 MHz is responsible for nearly 42% of all data transferred; that number is a little higher for urban areas, while it drops down to 33% for rural areas. The close correlation between the national and urban usage suggests that the bulk of AT&T’s data volume is transferred in urban areas, despite AT&T’s demonstrably good coverage even in rural areas.

One detail that is likely to become more important as demand for data grows is AT&T’s holdings in 2300 MHz. AT&T owns 95% of the WCS spectrum available for mobile broadband nationwide, and it views it explicitly as spectrum for adding capacity.

With the growth of unlimited plans as a staple in the US wireless market, capacity is a serious concern for all four major operators. Streaming mobile video has turned from a luxury to an expectation for many wireless subscribers, and despite efforts from operators to limit the quality (and strain) that streaming video places on their networks, the trend is only expected to continue. Adding capacity with the 2300 MHz spectrum is a relatively simple and cost-effective way for AT&T to keep its network quality consistent despite a growing demand for data.

Discover more of our data insights for the United States, and across the world, by joining Tutela Insights today.