Colombia

State of Mobile Experience

June 2022

State of Mobile Experience

June 2022

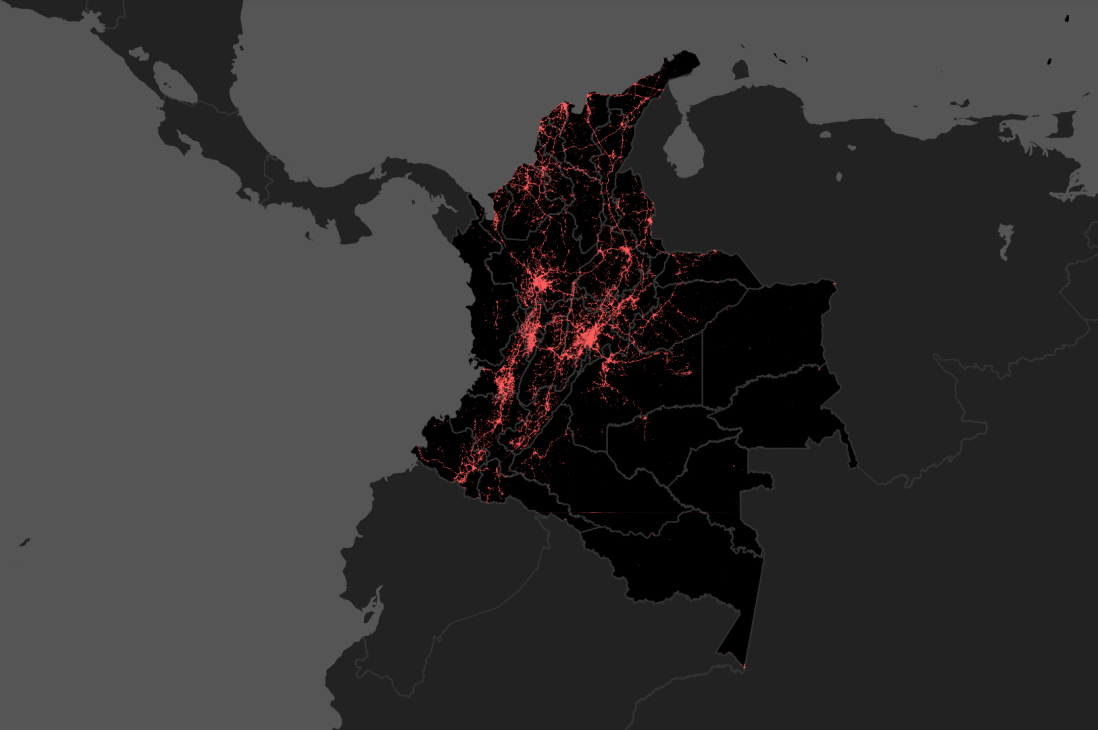

In our new benchmark report for Colombia, we have evaluated 3.3 million speed and latency tests, conducted on the smartphones of real-world users of national mobile operators within Common Coverage Areas, between December 2021 and May 2022.

The past two years of a world battling a pandemic have been a testimony to the growing dependence of people and businesses alike on telecoms services. According to a press release published by Communications Regulation Commission (CRC) in Colombia, mobile internet connections reached 38 million by December 2021 — a 16.8% increase from December 2020. 28.9 million of these were 4G connections. Keeping up with demand of this scale needs deliberate efforts and several such initiatives were undertaken in the country by regulators and operators alike.

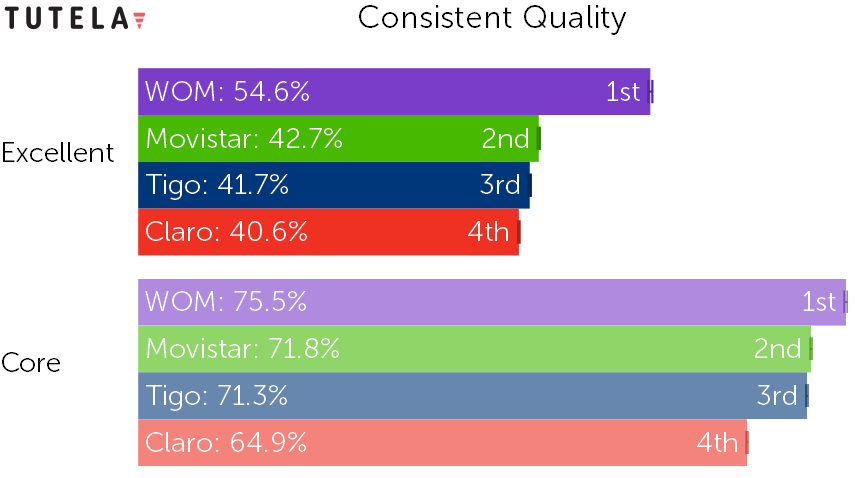

The biggest disruption that the Colombian mobile market has seen recently is the launch of a new entrant — WOM Colombia. Since the operator’s launch in April 2021, WOM claims to have gained 2 million mobile subscriptions in the country and deployed 3,832 cell sites. As our report demonstrates, the operator has become a dominant player for mobile network consistency as it leads in both Excellent and Core Consistent Quality metrics. A new entrant provides more choices to the customers encouraging competition among operators to improve subscriber experience.

Additionally, Claro announced that it plans to complete its 2G network shutdown by December 2022 and 2G services will not be available to its users as of January 1, 2023. This freeing up of spectrum will be used for network modernization and increased efforts on 4G and in future, for 5G. Colombia is making slow progress when it comes to 5G deployment. While the timeline for a 5G spectrum auction has not been announced yet, The Ministry of Information and Communications Technologies (MinTIC) of Colombia released a public consultation and support document for 5G development. The purpose of this consultation is to share its results with the public and the document includes topics such as spectrum allocation, network modernization etc.

Report statisticsDate range: 1 December 2021 - 31 May 2022 Download & response tests = 3.3 million Operators

Claro |

Report statistics

Discover the top performing operators in our mobile experience results table.

-1.png?width=700&name=2021%20Awards%20table%20(23)-1.png) The contents of this report and the awards shown above are copyright Tutela; organizations may republish the awards and results above for editorial purposes; non-commercial uses and on unsponsored social media posts. For all other uses, please contact awards@tutela.com.

The contents of this report and the awards shown above are copyright Tutela; organizations may republish the awards and results above for editorial purposes; non-commercial uses and on unsponsored social media posts. For all other uses, please contact awards@tutela.com.

This report encompasses the following experience KPIs:

To ensure a fair comparison between operator performance, Tutela limits the results used in our comparisons to those collected within Common Coverage Areas.

Learn more about our benchmarking methodology here.

WOM had the highest Excellent Consistent Quality with 54.6% of connections good enough for demanding applications like 1080p video streaming, HD group video calling and real time mobile gaming in Common Coverage Areas across Colombia. Trailing by 11.9 percentage points, Movistar came in second with an Excellent Consistent Quality of 42.7%. Tigo was close behind at 41.7% while Claro placed fourth with an Excellent Consistent Quality of 40.6% — a lag of 14 percentage points behind the winner WOM.

With a score of 75.5%, WOM took the lead for Core Consistent Quality, Tutela’s metric that represents the percentage of the time that our users’ average experience met the minimum recommended performance thresholds for lower performance applications including SD video, voice calls and web browsing. Movistar placed second, missing the top spot by a mere 3.7 percentage points. Tigo was extremely close to Movistar with a score of 71.3%. Claro on the other hand was further behind at 64.9%, trailing first placed WOM by 10.6 percentage points.

The table below shows a breakdown of individual KPIs for each operator.

| Claro | Movistar | Tigo | WOM | |

| Download % above 5 Mbps | 71.5% | 69.8% | 74.2% | 77.6% |

| Upload % above 1.5 Mbps | 87.8% | 87.8% | 94.1% | 90.8% |

| Latency % below 50 ms | 95.6% | 91.4% | 97.7% | 95.2% |

| Jitter % below 12 ms | 96.0% | 91.6% | 90.2% | 96.8% |

| Packet discard % below 1% | 73.9% | 80.9% | 69.2% | 82.1% |

At Tutela we take data privacy seriously and do not collect any sensitive personal information. Please read our Privacy Charter (PDF) to learn more. Opt out (Do Not Sell My Info)

+1 (855) 6-TUTELA